#OREGON TAX TABLES 2020 DRIVER#

The biggest driver of this change was a 0.125 percentage-point increase in Clark County, home to Las Vegas. Nevada’s combined ranking moved from 14 th to 12 th. Meanwhile, a 1 percent increase in Tuscaloosa’s local sales tax helped take Alabama’s combined rank from 5 th to 4 th. Louisiana moved from third to second highest when East Baton Rouge increased its parish sales tax by half a percent. Part of this increase can be traced to the city of Evanston, which raised its city tax from 1 percent to 1.25 percent, and to Marion City, which raised its sales tax from 8.75 percent to 9.5 percent in an attempt to pay down city-levied property taxes. The five states with the highest average local sales tax rates are Alabama (5.22 percent), Louisiana (5.07 percent), Colorado (4.75 percent), New York (4.52 percent), and Oklahoma (4.44 percent).Īverage local rates rose the most in Illinois, changing the state’s combined ranking from 7 th highest to 6 th highest. (The state rate is now officially 4.85 percent, but the state collects an additional 1.25 percent in mandatory taxes that are distributed to local governments, in addition to local option taxes imposed by localities. No state rates have changed since April 2019, when Utah’s state-collected rate increased from 5.95 percent to 6.1 percent. Five states follow with 4 percent rates: Alabama, Georgia, Hawaii, New York, and Wyoming. The lowest non-zero state-level sales tax is in Colorado, which has a rate of 2.9 percent. Four states tie for the second-highest statewide rate, at 7 percent: Indiana, Mississippi, Rhode Island, and Tennessee. The five states with the lowest average combined rates are Alaska (1.76 percent), Hawaii (4.44 percent), Wyoming (5.34 percent), Wisconsin (5.46 percent), and Maine (5.50 percent).Ĭalifornia has the highest state-level sales tax rate, at 7.25 percent. The five states with the highest average combined state and local sales tax rates are Tennessee (9.53 percent), Louisiana (9.52 percent), Arkansas (9.47 percent), Washington (9.21 percent), and Alabama (9.22 percent). Of these, Alaska allows localities to charge local sales taxes. Combined Ratesįive states do not have statewide sales taxes: Alaska, Delaware, Montana, New Hampshire, and Oregon.

#OREGON TAX TABLES 2020 FULL#

Table 1 provides a full state-by-state listing of state and local sales tax rates. This report provides a population-weighted average of local sales taxes as of January 1, 2020, to give a sense of the average local rate for each state. These rates can be substantial, so a state with a moderate statewide sales tax rate could actually have a very high combined state and local rate compared to other states.

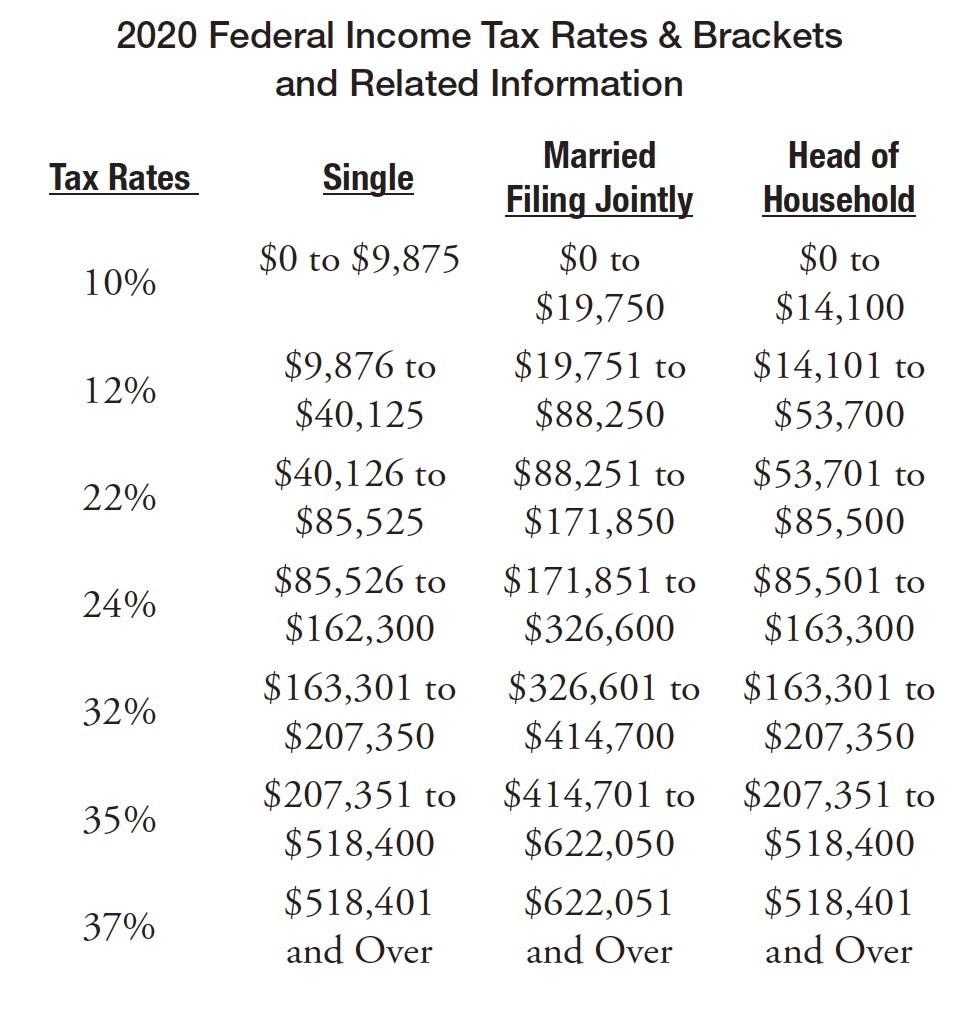

In addition to state-level sales taxes, consumers also face local sales taxes in 38 states. While graduated income tax rates and brackets are complex and confusing to many taxpayers, sales taxes are easier to understand consumers can see their tax burden printed directly on their receipts. Retail sales taxes are one of the more transparent ways to collect tax revenue. Sales tax rate differentials can induce consumers to shop across borders or buy products online.

No state rates have changed since Utah increased the state-collected share of its sales tax from 5.95 percent to 6.1 percent in April 2019.The five states with the highest average combined state and local sales tax rates are Tennessee (9.53 percent), Louisiana (9.52 percent), Arkansas (9.47 percent), Washington (9.21 percent), and Alabama (9.22 percent).In some cases, they can rival or even exceed state rates. Local sales taxes are collected in 38 states.Forty-five states and the District of Columbia collect statewide sales taxes.

0 kommentar(er)

0 kommentar(er)